How to Invest

How to Invest

OK, you’ve made it this far and you want to do this. Great! As mentioned in Investing is Easy, there are two main principles here:

One: Create a well-diversified global portfolio of equities (stocks) and fixed-income instruments such as bonds. The fixed-income component ensures you’re always getting paid, no matter what happens to equity markets, and it also serves to lower the volatility of your portfolio. A 60-40 mix of equities versus fixed income (bonds) has proven over time to provide good growth along with the ability to mitigate the immediate impact of financial storms.

Two: Keep your portfolio low-cost. Minimize the fees you pay by building a passive portfolio of very low cost exchange traded index funds (ETFs), or alternatively a low-cost passive or actively managed balanced fund with a good track record.

If you build your own ETF portfolio, you’ll need to re-balance it once or twice a year to ensure you’re not only maintaining a proper 60/40 split, but also the right balance between U.S, Canadian, and International equities. As an armchair investor, even this amount of work may seem like too much to you. Worry not! You can still do this one of two ways: by buying a super low cost 'all in one' ETF that has and does everything you need, or by engaging a ‘robo-advisor’ service which will do it for you at a very reasonable cost. More info on these options below!

If you decide to buy a low-cost balanced mutual fund, all the work is done for you. Although the annual management costs will likely be a bit higher than an ETF portfolio, there are generally no additional charges as you make contributions during the year. In contrast, if you plunge ahead as a do-it-yourself (DIY) investor, ETF purchases come with trading charges, usually in the $10 range when using an online discount broker.

OK. Now your head is spinning. Relax. It's easy.

Here are some examples of how to do it:

ETF investing

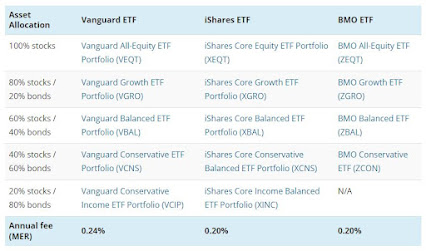

Use an 'all-in-one' ETF. For most investors, this is by far the easiest, least costly, and best way to go. Major companies such as Vanguard, Blackrock (iShares), Global X (formerly Horizons), and BMO all offer great all-in-one ETFs that provide you with an instant, globally diversified portfolio to align with your goals and risk tolerance: conservative, balanced, or growth. Typically, a balanced portfolio ETF will offer a 60/40 mix of global equity and fixed income (bonds). A growth portfolio ETF might contain an 80/20 allocation of equities vs. bonds, and a conservative portfolio ETF could be 20/80 equities to bonds. The Canadian Couch Potato website has an excellent summary of some of the asset-allocation offerings available.

Use a robo-advisor. Check out some of the top Canadian services, such as WealthSimple and JustWealth. They’ll do everything for you at a very reasonable cost, and they’ll keep the records and provide you what you need for tax reporting. And they maintain very user-friendly websites where you can log on and watch what’s happening with your investments. They also have real investment advisors on staff that can be reached by telephone or email or online chat, to answer any questions you might have. As an added bonus, if you’re just starting out and don’t have too much to invest (under $5000), they may even take you on as a client for free.

Mutual Fund Investing

Buy a nice, ho-hum but solid balanced fund that is low-cost and either passively or actively managed. If you are just starting out, opening an account at Tangerine is probably the best way to go. If you have more money to invest, you may want to skip Tangerine and approach a well-established, low-cost firm like Mawer Investments or Steadyhands. You really can’t go wrong with any of these. Both Mawer and Steadyhands have stellar reputations in the industry, are well-managed, and you will both sleep well and prosper over the long run.

A Note about Non-Registered Accounts

Most people, especially when starting out, concentrate on investing within their TFSA and RRSP accounts. If you’re one of those lucky people who have enough money that you’ve maxed out your TFSA and RRSP contribution room, you’ll then likely start investing in a non-registered investment account.

The problem of course with a non-registered investment account is that, unlike a TFSA or an RRSP, they are fully taxable. So while your investment goals will remain the same, once you open a non-registered investment account, you’ll need to strategize a bit to ensure you don’t get clobbered with tax on an ongoing basis. There are a number of ways to do this, but essentially it involves keeping tax-advantaged products in your non-registered account, and keeping the otherwise highly-taxable stuff in your TFSA and RRSP.

When you get to that point, unless you’re a hard-core DIYer, you might need help. The robo-advisor and mutual fund firms we mentioned here as examples will be more than happy to help you with tax-planning stratagies as your assets grow.

If you really want to go DIY

If you really want to go DIY while keeping your costs low and maintaining a properly diversified portfolio, go to the Moneysense site and learn about Couch Potato investing.

If you want to pick stocks and build your own equity portfolio, good luck with that. While stock picking can be fun, and sometimes very profitable, it can also ruin you if you don’t do it right.

Stock picking is way beyond the scope of armchair investing.

Comments

Post a Comment